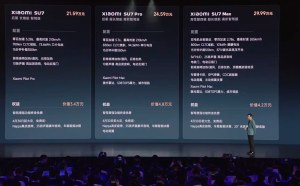

Xiaomi Motors: On March 28th, the Xiaomi SU7 was officially released. The Xiaomi SU7 will debut in 9 colors, with the standard version costing 215900 yuan; PRO version 245900 yuan; The MAX version costs 299900 yuan. The Xiaomi SU7 has a long range across all models, with a standard starting range of 700 kilometers under CLTC conditions. The Xiaomi SU7 Max version achieves a 2-second level 0-100 km/h acceleration and a range of 800km/h. According to Xiaomi Auto Weibo, after 27 minutes of listing, 50000 units were ordered. ( YUAN means CNY = RMB)

Image source: Xiaomi Auto Launch Event

Xiaopeng Motors has officially entered the German market and launched two models, the Xiaopeng G9 and the Xiaopeng P7, with a price range of 57600 euros to 69600 euros. The price range of Xiaopeng P7 is between 49600 euros and 69600 euros.

Ideal Automobile: On March 28th, the fully self-developed multimodal cognitive big model Mind GPT was officially launched, becoming the first car manufacturer to pass the record for self-developed big models.

Toyota Motor: Including its subsidiaries Daihatsu and Hino Motors, the global production in February reached 789138 units, a year-on-year decrease of 12.1%; Global sales reached 753648 units, a year-on-year decrease of 12.0%. Among them, the sales volume in the Chinese market was 83332 units, a year-on-year decrease of 35.7%.

Stellantis: layoffs have been gradually initiated in North America and Europe. Following the layoffs of 400 technical workers and software engineers in the United States last week, the company has signed further voluntary layoffs agreements with Italian unions, raising the number of layoffs to over 3000.

Parts Enterprises

Tianqi Lithium Industry: In 2023, its operating revenue was 40.5 billion yuan, a slight increase of 0.13% year-on-year. The net profit attributable to the parent company decreased significantly to only 7.297 billion yuan, a decrease of 69.75% from the previous year’s 24.125 billion yuan.

Desai Xiwei: In 2023, its operating performance reached a new high, with revenue exceeding 20 billion yuan and annual sales of new project orders exceeding 24.5 billion yuan. Among them, the revenue scale of intelligent cockpit products and the annual sales revenue of new project orders have both exceeded 15 billion yuan; The intelligent driving business achieved a total annual revenue of 4.485 billion yuan, a year-on-year increase of 74.43%, and an annualized sales revenue of 8 billion yuan for new project orders.

China Auto News: On March 28th, Yutong released over 10 new products covering all scenarios and categories of transportation, logistics, and operations. To address the core demands of users, Yutong, in collaboration with its strategic partner Ningde Times, has broken through key technologies such as artificial SEI film, nano shield positive electrode, and low lithium consumption negative electrode, and has taken the lead in launching a 15 year and 1.5 million kilometer warranty for long-life batteries in the industry.

SK On: Signed a memorandum of understanding with Italian luxury sports car manufacturer Ferrari to strengthen cooperation and promote battery technology innovation. SK On is currently Ferrari’s only battery supplier and has been providing battery cells to Ferrari since 2019.

Industrial Economy

Guangzhou Automobile Group: In 2023, it achieved a total operating revenue of approximately 502.3 billion yuan based on consolidated standards, and a total operating revenue of approximately 129.7 billion yuan based on consolidated standards, a year-on-year increase of 17.62%. The total annual dividend payout is approximately 1.57 billion yuan, with a planned final dividend of 1 yuan per 10 shares (including tax) and an annual dividend payout rate of nearly 36%. Guangzhou Automobile Group also announced plans to increase the repurchase efforts of A-shares and H-shares, with a total repurchase fund scale of RMB 500 million to 1 billion.

Dongfeng Motor: In 2023, its revenue was approximately 99.315 billion yuan, an increase of approximately 6.652 billion yuan or 7.2% compared to the same period last year, which was approximately 92.663 billion yuan. In 2023, shareholders should account for a loss of approximately 3.996 billion yuan, a decrease of approximately 14.261 billion yuan from the same period last year when shareholders should account for a profit of approximately 10.265 billion yuan. The overall sales target of the group for 2024 is 2.7 million vehicles, an increase of approximately 29% compared to the sales in 2023.

Evergrande Automobile: In 2023, the group’s total revenue was RMB 1.34 billion, with a gross loss of RMB 51 million; The total net loss was RMB 11.995 billion, a year-on-year decrease of 56.64%. The discontinued business (i.e. divestment of real estate projects) incurred a loss of RMB 1.061 billion, non operating losses such as asset disposal and impairment amounted to RMB 6.384 billion, and operating losses amounted to RMB 4.55 billion.

Huachen China Automotive Holdings Co., Ltd.: In 2023, its revenue was 1.121 billion yuan, a year-on-year decrease of 0.82%, and its net profit for the year was 7.73 billion yuan, a year-on-year increase of 8.2%.

CITIC Securities: Musk has sent an email to all Tesla employees requesting North American employees to install and activate FSD V12.3.1 before delivering the vehicle, providing a FSD test drive experience for new customers. Meanwhile, Tesla will launch a one month FSD free trial service for its new car in North America this week. This means that Tesla FSD V12 is accelerating its landing in North America, and a comprehensive launch is just around the corner. The new end-to-end architecture is expected to significantly enhance FSD’s intelligent driving capabilities and user experience, and Tesla’s intelligent driving is expected to usher in its own ChatGPT moment.

Policy Situation

Shanghai Mayor Gong Zheng: Strengthen “3+6” and focus on building an innovative highland for emerging industries. “3” refers to the three leading industries entrusted by the central government to Shanghai, namely integrated circuits, biopharmaceuticals, and artificial intelligence. Last year, the scale of these three leading industries reached 1.6 trillion yuan. “6” is one of the six key industries with distinctive characteristics and foundation in Shanghai. We need to accelerate the construction of four trillion level industrial clusters, namely electronic information, life and health, automobiles, and high-end equipment, and two 500 billion level industrial clusters, namely advanced materials and fashion consumer goods.

CCTV Finance: Recently, various regions have promoted automobile consumption through various policies. In Harbin, Heilongjiang, a total of 30 million yuan of government consumption promotion funds will be disbursed, and some car dealers have also launched multiple promotional activities simultaneously. As the first event of the 2024 “Consumption Promotion Year” Ningxia Consumer Benefiting People series, local policies such as old car discounts and new car subsidies are combined to provide consumers with a maximum subsidy of 7000 yuan for purchasing new cars.

Change of Personnel

Zotye Automobile: Due to personal reasons, Lian Gang has applied to resign from his position as CEO of the company. After resigning, Lian Gang continued to serve as a director of the 8th Board of Directors, a member of the Strategy Committee of the Board of Directors, and a member of the Nomination Committee of the Board of Directors. During the vacancy period of the CEO, the company’s Chairman Hu Zeyu will act as the CEO.

BAIC Group: According to the decision of the Municipal Party Committee and Government, Comrade Zhang Jianyong will serve as the Party Secretary and Chairman of BAIC Group Co., Ltd., while Comrade Jiang Deyi will no longer serve as the Party Secretary and Chairman of BAIC Group Co., Ltd.